Managing money can feel overwhelming, especially when your income barely seems to cover your expenses. But what if there was a simple formula to help you spend wisely, save effectively, and still enjoy life? That’s where the 50/30/20 rule comes in.

This approach to budgeting is so straightforward that anyone can use it, no matter how much or little they earn. It’s designed to make financial management easier and ensure you always have enough for your needs, wants, and future.

What Is the 50/30/20 Rule?

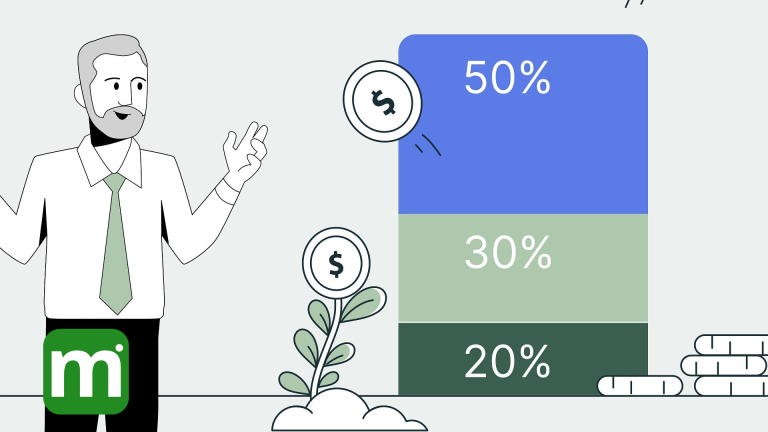

The 50/30/20 rule is a budgeting method that splits your income into three categories:

- 50% for needs

- 30% for wants

- 20% for savings and debt repayment

It helps you prioritize your spending and ensures that your essential expenses are covered first, without neglecting your future. It’s all about balance — taking care of the necessities, enjoying your life, and saving for tomorrow.

Breaking Down the 50% for Needs

Let’s start with the first category — needs. These are the things you can’t live without. Think of them as the basics required to keep your life running. These include:

- Rent or mortgage payments

- Groceries

- Utilities like electricity, gas, and water

- Transportation (car payments, public transport)

- Insurance (health, car, or home)

Basically, anything you must have to maintain a safe, functional, and stable lifestyle falls under needs. The goal here is to keep your essential expenses within 50% of your income. So if you earn $2,000 a month, you’ll aim to spend no more than $1,000 on your needs.

But here’s where it gets tricky: distinguishing between needs and wants can sometimes be hard. For example, having a home is a need, but living in an expensive neighborhood with high rent may be a want. Eating is a need, but dining out at fancy restaurants is not. This is where you must get honest with yourself and make necessary adjustments if your needs are taking up more than 50% of your income.

Allocating 30% for Wants

Now for the fun part — wants. This is where you get to enjoy the fruits of your labor. Wants are the non-essential expenses that add enjoyment to your life, such as:

- Eating out or ordering takeout

- Entertainment (Netflix, movies, concerts)

- Vacations and travel

- Hobbies and leisure activities

- Upgrading your phone or gadgets

Spending money on wants is important because it keeps you motivated and happy. The 30% portion of the rule allows you to indulge in things you enjoy without going overboard. Let’s say your monthly income is $2,000. You would budget $600 for your wants.

Of course, it’s easy to overspend in this category, especially when you’re surrounded by temptations. But sticking to your 30% allocation helps you avoid lifestyle inflation — the tendency to increase spending as your income grows. Instead of splurging on every new gadget or vacation, being mindful of your wants will keep you financially stable and stress-free in the long run.

Saving 20% for the Future

Finally, we get to the most critical part of the 50/30/20 rule — savings and debt repayment. This 20% is what will set you up for financial freedom and security. Here’s what falls under this category:

- Building an emergency fund

- Saving for retirement

- Paying off loans or credit card debt

- Investments (stocks, bonds, real estate)

If you want to achieve your financial goals, it’s essential to prioritize saving at least 20% of your income. For instance, if you earn $2,000 a month, $400 should go into savings or debt repayment.

You could start by setting up an emergency fund with enough money to cover 3-6 months of living expenses. This safety net will protect you from unexpected expenses like medical emergencies, car repairs, or job loss. Once you have that in place, you can begin saving for long-term goals like retirement or a home purchase.

If you have debt, use part of your 20% to aggressively pay it down. Reducing high-interest debt will free up more of your future income for savings and investments. The sooner you tackle debt, the more peace of mind you’ll have.

How to Implement the 50/30/20 Rule in Your Life

You might be thinking, “This all sounds good, but how do I make it work for me?” Don’t worry — implementing the 50/30/20 rule is simpler than you think.

Here’s how to get started:

- Calculate Your Income: First, determine your total monthly income after taxes. This includes your salary, side hustle earnings, or any other sources of income.

- Break Down Your Budget: Next, split your income into the 50/30/20 categories. For example, if you earn $3,000 a month, your budget would be:

- $1,500 for needs (50%)

- $900 for wants (30%)

- $600 for savings/debt repayment (20%)

- Track Your Expenses: Use a budgeting app like Monesize or a simple spreadsheet to track where your money goes. This will help you stay within your limits for each category.

- Make Adjustments: If you find that your needs are eating up more than 50% of your income, look for areas where you can cut back or find cheaper alternatives. The same goes for your wants if you’re overspending there.

- Be Consistent: Stick to your plan, but allow flexibility if your circumstances change. Consistency is key, but your budget should be adaptable to major life events like a job change, relocation, or new financial goals.

The Benefits of Using the 50/30/20 Rule

What makes the 50/30/20 rule so powerful is its simplicity and flexibility. It’s easy to understand and follow, yet effective enough to keep your financial life on track. Here are some of its key benefits:

- It promotes balance: You’re not forced to cut out all spending on fun. Instead, the rule encourages balance between enjoying life now and securing your future.

- It’s customizable: You can adjust the percentages slightly based on your personal situation. For example, if you live in a high-cost area, you might allocate 55% for needs and 25% for wants.

- It builds healthy habits: By automatically setting aside 20% for savings or debt repayment, you’re building a strong foundation for financial stability and independence.

Conclusion: Take Control of Your Finances

The 50/30/20 rule offers a simple, stress-free way to manage your money. By dividing your income into needs, wants, and savings, you can live within your means while also preparing for the future.

Start applying this rule today, and watch how quickly your financial life transforms. You’ll feel more confident, in control, and ready to tackle whatever financial challenges come your way. Take the first step toward mastering your money!